Individual Retirement Account (IRA) basics

Traditional IRA vs. Roth IRA

An Individual Retirement Account (IRA) is a retirement savings account established with a financial institution that allows you to save for retirement in a tax-advantaged way. The two primary kinds of IRAs are the traditional IRA and the Roth IRA. Qualifying individuals can contribute to both kinds of IRAs even if they also contribute to an employer-sponsored retirement plan.1

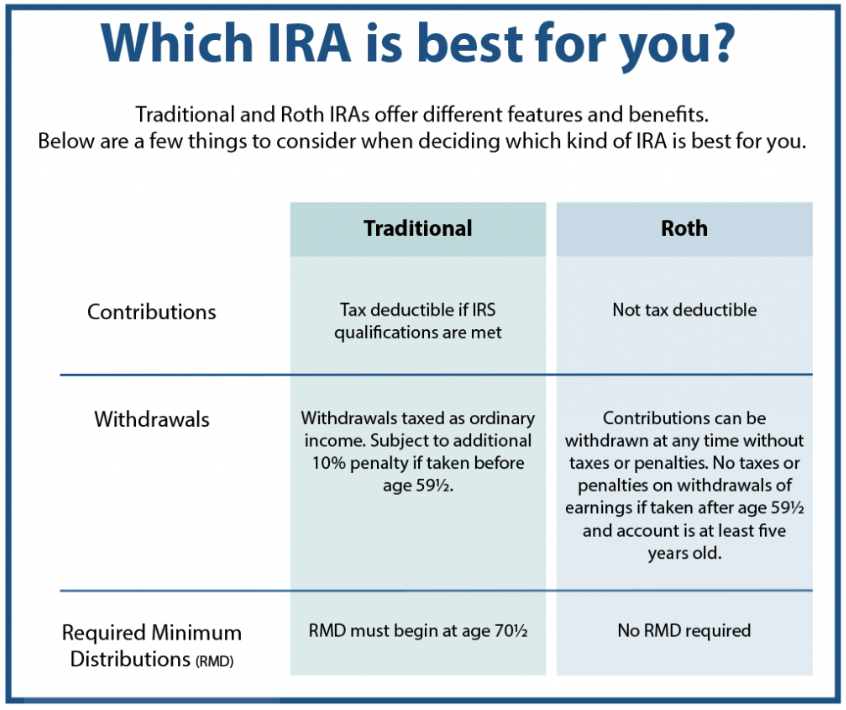

With a traditional IRA, your contributions may be fully or partially deductible from your taxable income, which reduces your income taxes.2 Your money grows tax-deferred until it’s withdrawn in retirement, at which time it’s taxed as ordinary income. While contributions to a Roth IRA don’t reduce your taxable income, your account grows tax free and qualified withdrawals are free of income taxes.

Which IRA is best for you?

Your modified Adjusted Gross Income (AGI), or the combined AGI of you and your spouse, determines both your eligibility to contribute to a Roth IRA and your eligibility to make taxdeductible contributions to a traditional IRA.

Although your AGI may disqualify you from contributing to a Roth IRA, you are always free to contribute to a traditional IRA regardless of your income. If you qualify to make tax deductible contributions, a traditional IRA might make more sense.2 If you don’t qualify, then a Roth IRA might work better as long as you meet the income requirements for eligibility.3 Other things to consider when choosing between a Roth and a traditional IRA include:

- If you expect to be in a higher tax bracket in retirement, a Roth IRA is generally more appropriate.

- You can withdraw your contributions from a Roth IRA (but not investment earnings) at any time for any reason. With a traditional IRA, you generally must wait until age 59½.

- You must begin taking Required Minimum Distributions (RMD) from a traditional IRA when you reach age 70½. A Roth IRA has no RMD.

You can convert a traditional IRA to a Roth IRA. However, you will have to pay income taxes on the amount you convert.

1. Combined contributions to Roth and traditional IRAs cannot exceed $6,000 in 2020 ($7,000 for individuals age 50 or older).

2. If you and your spouse (if you file a joint tax return) do not participate in an employer-sponsored plan, your contributions to a traditional IRA are 100% tax deductible. Otherwise, deductibility is phased out above certain modified AGI limits.

3. For the 2020 tax year, single and head of household tax filers with a modified AGI of up to $124,000 and joint filers with a modified AGI of up to $196,000 are eligible to make the maximum annual Roth IRA contribution. Above these limits, eligibility is gradually phased out.