Maintaining a long-term focus

The stock market’s history of volatility and growth

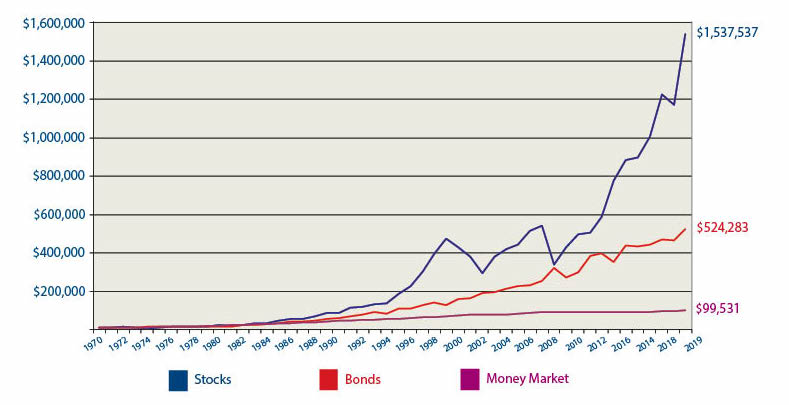

As we all struggle with the unprecedented coronavirus crisis and the corresponding stock market crash, it may provide some small degree of comfort to view the current market turmoil from a historical perspective. When investing for the long term, it’s important to keep in mind that while stocks have far outperformed other investments over the long term, they have also been subject to short-term periods of sharp decline.

Financial Market Performance

Growth of $10,000 investments

From January 1, 1970 – December 31, 2019

Source: Morningstar Office. Stocks measured by Standard & Poor’s 500 Index, bonds by the Ibbotson Associates SBBI US Long-Term Government Bond Index, and money market by the SBBI US 30-Day Treasury Bill Index. All results assume reinvestment of dividends on stocks or coupons on bonds and assume no taxes. It is not possible to invest directly in an index. The hypothetical investment results are for illustrative purposes only and should not be deemed a representation of past or future results. Actual investment results may be more or less than those shown.

The graph above illustrates the growth of hypothetical $10,000 investments in stocks, bonds and money market securities over the last 50 years. Notice that during this 50-year period, stocks have provided vastly superior long-term performance than bond or money market investments, but at the same time have subject to a far higher level of short-term volatility. This volatility is illustrated by the more dramatic peaks and valleys of the blue line depicting stock market performance. Note that at the end of the fifty-year period, the $10,000 stock investment has grown to nearly three times the amount of the bond investment, and more than five times the amount of the money market investment.

Included in this 50-year time period were the “2nd Black Monday” stock market crash of 1987, the “dot-com bust” crash of 1999–2000, and the “Great Recession” crash of 2008. Following these and other significant stock market declines, the market rebounded to eventually reach new record highs. While past stock market performance is not a guarantee of future results, the historical performance of the market suggests it will eventually recover from its current decline just as it did with previous ones.

It is possible to lose money by investing in a money market fund. Although the fund seeks to preserve the value at $1.00 per share, it cannot guarantee it will do so. The fund may impose a fee upon the sale of shares or may temporarily suspend sales of shares if its liquidity falls below required minimums because of market conditions or other factors. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide such support at any time.