3 tools to help build your retirement savings

All teachers have that one class that makes them feel like retirement can’t come soon enough. If that’s you this year, then it’s time to kick your savings into high gear. However, saving like you are in a mad dash toward retirement takes the dedication of a marathoner. Here are three tools to help you build your retirement savings.

1. Calculate how much you need to save

The question of how much you need to save for retirement can be as big a buzzkill as seeing a back-to-school ad on your first day of summer vacation. The many variables used to determine your retirement savings needs can make calculating this magical number complex.

But, once you’ve done some mental math and have a goal number in mind, our Investment Goal Calculator can help you figure out what you need to save today to get there. With it you can explore the many factors involved, including your initial savings, periodic contribution amounts and frequency, years to accumulate, interest compounding, inflation and more. By experimenting with these numbers using the calculator, you’ll see what you can do today to reach your retirement investment goal.

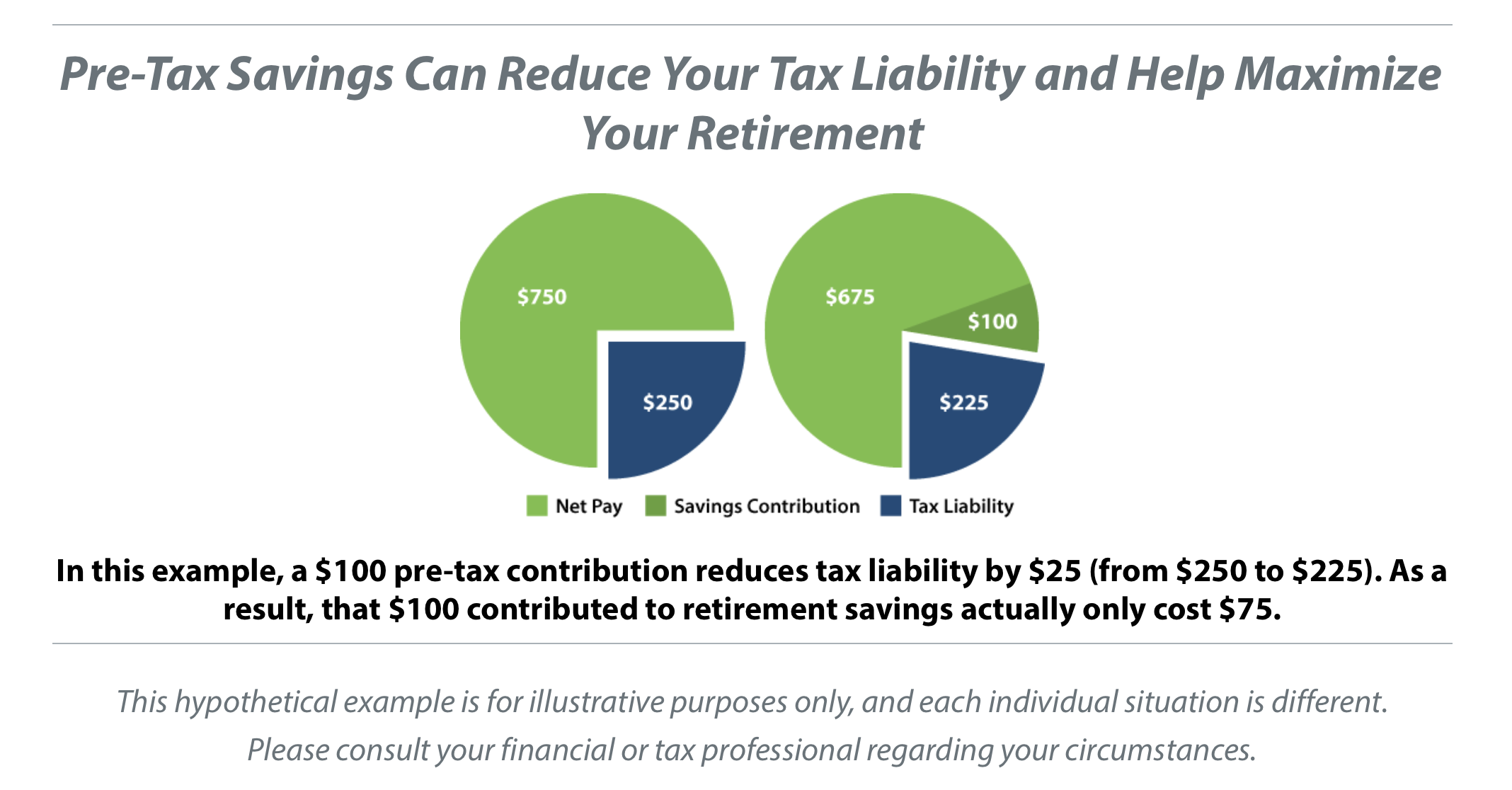

2. Pre-tax savings

Also referred to as “tax-deferred” savings, in that it’s income you won’t pay taxes on now, but will when withdrawing from your retirement savings, pre-tax savings is automatically taken from your paycheck and deposited in your retirement savings plan. It can make saving for retirement easy and help you avoid the feeling that you’ve got to give something up to save. Because the money is automatically deposited into your savings instead of your bank, it doesn’t necessarily feel like you’re making a sacrifice. For those who have trouble saving, this may help establish positive savings habits.

3. A savings app

Digital spending has become increasingly easy and convenient with applications like Venmo, Amazon Prime, and other retailers who make paying for goods and services a simple click of a button. Saving for retirement with the help of apps can be equally as simple. Try these apps to help you save using digital technology.

Created by Intuit, Mint helps you create budgets, categorize spending to eliminate superfluous expenses, pay bills, vet credit card programs, and review your overall financial picture to find ways to save money and reduce fees. As a smartphone app, Mint can send you notifications and reminders to help keep you on track.

Qapital and Acorns are both savings apps built on the idea of investing leftover funds into a savings account. Qapital invests unspent budget surplus into your savings account and allows you to set reminders to save when ad-hoc or contractor payments are received. Acorns use what they call ‘micro-investing.’ For each purchase you make, Acorns will round up to the nearest dollar and automatically invest the spare change.

Budgeting apps like Mvelops and Claritymoney help you monitor your spending and both suggest ways to save, plus alert you if you go over budget. Clarity Money goes so far as to use AI to monitor your spending habits. Mvelopes uses Certified Budgeting coaches to help you stay on budget and increase your savings.